Real Shareholder Value??=Real Deal Required

Premise/Summary: Anticipated acceleration/explosion in business ownership desired exits is increasing demand for valuation "coaching" services, & exit liquidity event preparation. Owners are cautioned to perform their own due diligence in hiring those purporting to be deal and due diligence experts.

Premise/Summary: Anticipated acceleration/explosion in business ownership desired exits is increasing demand for valuation "coaching" services, & exit liquidity event preparation. Owners are cautioned to perform their own due diligence in hiring those purporting to be deal and due diligence experts.

STAYING THE COURSE & FINISHING STRONG: It absolutely is all about the numbers

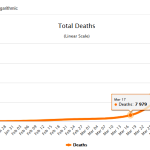

Premise/Summary: This article attempts to propose a very simple, admittedly rather scientifically unsophisticated model to consider the potential impact and risks of Covid-19 in terms of a concerted effort to “re-open” the economy for business within the next few weeks. I would suggest the economic risks/potential impairment costs of “too much, too soon, too quickly” outweigh the risks of not aggressively pushing to “get back to work”.

STAYING THE COURSE

Premise/Summary: This article attempts to propose a very simple, admittedly rather scientifically unsophisticated model to consider the potential impact and risks of Covid-19 in terms of a concerted effort to “re-open” the economy for business within the next few weeks. I would suggest the economic risks/potential impairment costs of “too much, too soon, too quickly” outweigh the risks of not aggressively pushing to “get back to work”.

STAYING THE COURSE

Portate Bien!-How to Quickly/Accurately Identify Opportunities to Lean-Up & Clean-up Operations

Prioritizing and accelerating investments in cost management excellence can produce absolutely outstanding ROI, dramatically faster pay-backs, at minimal investment risk than just about any initiative available to organizations. This initial conversation is Part one in a multi-part series of articles that discusses why this must always remain top of mind, top of the list and how to develop and maintain this critical capabilities premium. 2019.11.18 Identifying-Correcting Bad Behavior

A story of the power of the spirit to just keep on, keeping on when in the midst of the moment.

2017.02.14 A Willing Spirit

2017.02.14 A Willing Spirit

Using Value Range DashBoards To Stay On Track

Overcoming our collective ADD. Using ValueRange Dashboards To Stay On Track

Sifting Through The Electronic Trash-Science & Art of Pub Records Searches

Stradling That Very Fine Mendoza-Daubert Line: Resisting The Temptation To Cut Corners Or Advocate

2016.04.18 Straddling The Mendoza Line

Valuing a Dream-Lost Profits for Development-Stage Start-Up

Buying A Business Start To Finish

Top M & A mistakes Due Diligence-Financial & Operations Risk Analysis & Assessment Debt & Equity-Financing The Deal Considerations & Trends

Valuing A Dream-Lost Profits With a Development Stage Start-up

Presented December 2014. Valuing a Dream-Lost Profits for Development-Stage Start-Up Presentation Dec 2014

The Value Examiner Sept.-Oct 2014 Special Edition

Value Examiner Sept-Oct 2014 A very special look at the rapidly changing landscape of professional sports valuation and the extraordinary impact of technological and demographical change that is driving it.

Case For The Cards-An Executive MLB Scorecard

A Case For The Cards-Value Examiner Sept-Oct 2014 After 29 very long years, KC is once again playing October playoff baseball and the excitement is epic. Yet for our friends 3 1/2 hours to the East, it's business as usual. Hot off the presses, the Sept.-Oct. 2014 Value Examiner looks at professional sports valuations and we are pleased to be a part of this special, and very timely edition. Enjoy!!

The Wild, Wild West: Going-Concern Sales In Receivership

In certain situations, the sale of an operating entity as a going concern in a receivership proceeding is a viable alternative to seeking relief under the Bankruptcy Code. Receivership going-concern sales may be especially appropriate in complex situations where enterprise value is declining, but the company is not hopelessly insolvent. This article briefly highlights those conditions, factors, situations and circumstances that may contribute to or impede a successful going-concern transaction within a court-supervised commercial receivership. 2014.07 ABI Article

Tony Wayne

Sector Spotlight: Insolvency, Turnaround and Restructuring

Acquisition International

Make Every Day A Blast-New & Exciting Accounting & Finance Careers

Make Every Day A Total Blast